Terri Zeringue explores ways to effectively manage office expenses

“Why am I taking home less money even though my collections continue to grow?” This is a question we hear all the time. Increasing collections is just one component of improving your practice’s profitability. The other key driver is controlling expenses.

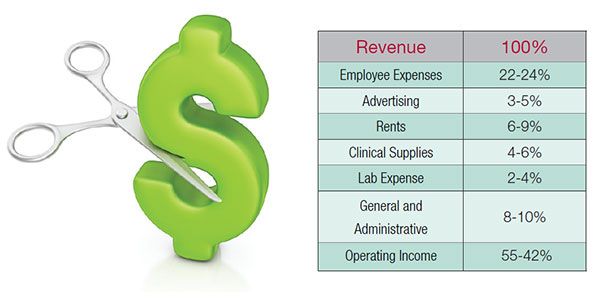

How much of the revenue collected can you realistically expect to find its way to the bottom line? A good goal to set would be 50%. While expenses can vary based on a variety of factors, the chart to the right is a general guideline on the percentage of your practice’s revenue that should be allocated to specific costs.

You may be saying, “WOW! Nearly a quarter of my revenue goes to my staff.” Keep in mind that while your employees are by far your largest expense, they are also your most valuable asset. If you are staffed adequately, schedule your employees appropriately, and if your team is working efficiently, you will be able to keep your cost under 24% of revenue. Employee expense is inclusive of all costs related to your staff including travel, medical insurance, 401k, employee education, uniform allowance, and employer taxes in addition to salaries. It’s not just about having the right number of people on your team, but having the right people on your team. Excessive turnover will negatively impact your expense in this area as well.

Determining how much money to invest in advertising depends greatly on where your practice falls in its life cycle. Whether you are newly in practice or already established in your community will determine not only the amount you should spend on advertising your practice, but also how those dollars should be spent. Always be sure to take advantage of extremely low cost or free marketing resources such as social media.

Numerous factors affect the cost of clinical supplies, the most relevant being the gloves used. Shop and compare prices, take advantage of specials, or consider joining a buying group. But before you purchase a year’s supply of gloves, evaluate the savings versus the impact of having your money sit on the shelf for 12 months. While large bulk purchases often seem appealing, they may not be the best option.

Building a budget for your practice can also help to control your costs. Review your budget at the beginning of every month, and think about how you will stay within those spending limits. Review again at month’s end. Look at the variances in your actual costs when compared to your budget. Why were you over budget? Was it just a timing issue, or do you expect this overage to continue in subsequent months? Closely monitor the trends and adjust your budget when necessary.

Quick cost saving tips:

- Take advantage of all early payment discounts. Vendors will often reduce the total invoice by a predetermined percentage if payment is received by a certain date.

- Always pay invoices timely to avoid interest and/or late fees. If you do incur a late fee, contact the vendor and ask him/her to reverse it. If you are not a habitual late payer, vendors will usually forgive the late fee in exchange for a prompt payment.

- While we all like to use our credit cards for payment to rack up points, be sure to pay your credit card bill in full each month or the interest charges will likely offset any rewards earned. Always weigh the value of the credit card rewards against other potential discounts or savings. Vendors may offer a discount for cash payments that outweigh the points you would receive from your credit card company.

- Don’t leave money on the table when renewing your lease. Landlords will almost always throw in some tenant improvement money that you can use to give your office a face lift.

- Evaluate the pros and cons of leasing equipment versus buying.

- Monitor for lost revenue from posting errors. Anyone can hit that zero key one too many times. If you accidentally post a $100 payment as $1,000, you have just reduced the patient’s balance by $900 that they did not pay and lost $900 that you will never collect. Balance your bank statement monthly comparing the amounts deposited to the amounts posted in your patient financial software to identify and correct any posting errors.

Most importantly, never take your eye off the ball. Annual financial reviews are not sufficient. Prepare financial statements each and every month, and address excessive expenses; those over your budgeted amounts or higher than the benchmarks referenced here. This simple process will put you on the road to financial success!

Stay Relevant With Endodontic Practice US

Join our email list for CE courses and webinars, articles and more..